A new month began yesterday (hello July!). A new month always makes me feel fresh and excited about a new beginning, similar to the way most people feel at the first of the year. I usually like to to choose one goal to focus in on specifically each month to try and challenge or better myself. For July, it’s budgeting.

I know, I know, I write about health, not finance. Believe me, I don’t claim to be an expert, but I had several requests to post on it, so here goes.

I’ve talked about budgeting before. Now that I pull up the post I see that I wrote it last July. Maybe I’m noticing a little pattern here? Anyway, to update you since my last post, Mint.com only lasted for a few months. It began having troubles syncing and it sent me so many email updates that I became annoyed and chucked it.

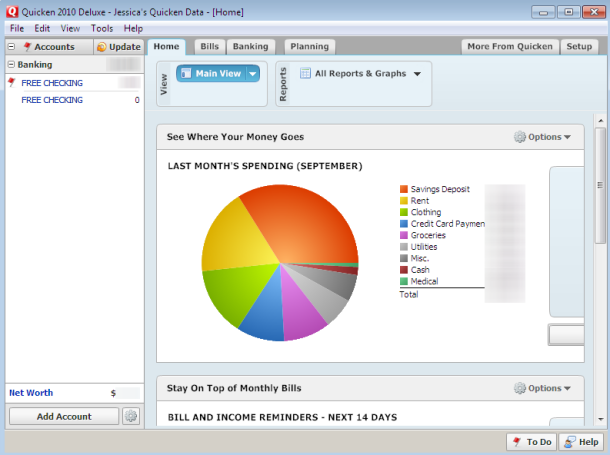

However, my financial organizing OCD kicked in again and I bought Quicken. It was a little overwhelming at first to get all our finances set up, but I did it. Then I didn’t open it for a while and when I did, categorizing all our purchases that had piled up made me want to smash my head through the computer screen. But, I did it and learned a lesson: attend to Quicken on a regular basis.

…please tell me you get the same giddy joy that I do out of pie graphs??

After reviewing previous months’ expenses, we found that our purchases differ greatly month to month, making it difficult to create a set budget that would work for all months, even with including a miscellaneous category. For example, one month we may be in town with no events to attend, but the next we may have an out of town wedding requiring a hotel stay and gift.

So, I decided I wanted to try Dave Ramsey’s advice to create a budget each month, before the month begins. He says “on paper, on purpose” though I assume “on the (com)puter on purpose” will work just as well. It sounds painstakingly dull and time consuming, but it was nice to sit down with David, discuss the upcoming month and allocate funds to each category accordingly. Also, it is empowering to find categories in the process that we can cut back on.

I have also discovered that I prefer a monthly grocery budget over a weekly because weeks can differ greatly, too, based on whether I need to restock the staples.

Our budget is all set up for July in Quicken now and I look forward to logging in throughout the week to categorize purchases and see how we are doing. Like any goal, it helps me when I have a clearly outlined plan and the ability to track my progress.

Being on the same page financially not only satisfies my inner control freak, it also strengthens our marriage. It reminds us both of our aspirations for our family’s future, which are our reasons to stay within a budget now. It’s easier to say no to eating out when we know it’s getting us closer to our big picture goals, like traveling.

So now you see that I’m not just a meal planning and exercise schedule loving type A personality, but the organization nerd in me overflows into all areas of my life. Don’t I sound like a ball of joy to hang out with?

How do you handle your finances?

Whitney says

LOVE that you are following Dave Ramsey’s advice. My church is a huge advocate of his and there are some amazing success stories that our members have given 🙂

Anna S. says

I use Mint to budget. I had to shut off the email notifications though (it made me angry!).

I need to start thinking of the big picture. I’m in a kind of in between place (just finished the class portion of grad school but I have to work an internship to actually finish which means I’m making very little) so it is hard for me to think monthly even. I mainly have to make little decisions to help save.

Brittany says

Maybe if I could have figured out how to turn off the notifications… 😉 I still get them and haven’t used it in months- haha!

Jen says

Funny you posted this today! We’ve been horrible w/ budgeting lately. So we sat down yesterday and decided we were going to track every penny spent in July to get a better handle on things. Good luck to you guys!

Brittany says

Tracking pennies makes me feel so in control. It’s a sickness, really. Good luck with your budgeting adventure!

Austin Michelle says

We have monthly budgets (with way too many categories) and we use an excel spreadsheet with pivot tables (nerd?) to update our spend.

I definitely like the budgets by category because then I don’t feel bad if I find an expensive pair of shoes or outfit as long as I stay in my budget (i.e. more than my husband would want to pay). I just know I won’t be able to get any other clothes that month! It works well for our groceries too because we spend so differently from week to week.

Brittany says

Like you, I like the categories because I know what I have to work with if I want a pricier item. Also, I don’t even know what pivot tables are, but I’m sure I ‘d love them if I did! I don’t know much about excel, which drives David crazy bc he is a wiz 🙂

Liz @ iheartvegetables says

I use mint.com which is perfect for me, because it’s easy, and I even have the mobile app, so I can check it before I go shopping (haha)

I’m REALLY working on my grocery budget. I was spending over $300 a month (and I was only buying groceries for myself!!!) Last month, I cut it down to less than $200, really by just being more aware of what I was buying!

Brittany says

I did like the mobile app! I miss that access for sure.

Kudos to you for cutting your grocery bill by over a third! That’s just impressive 🙂

Erica says

My boyfriend and I each automatically put as much as we can into savings every paycheck and give ourselves cash for the week to pay for groceries and fun activities. It’s been working really well for us and we don’t even miss the money since we swipe it over instantly!

Brittany says

I love that system! David really wants to get to the point where we do that, but I haven’t gotten a solid enough handle on how much we need each month yet because costs differ so much. I hope to switch to your way at some point 🙂

Katie says

Love dave ramsey! We learned a lot through his financial peace class our chuch does! So hopefully, especially once you have a baby! Groceries are always so hard to stay in budget though!

Hallie@ChasingHallie says

We recently use Mint to budget and I too need to login cuz its been awhile.

Unfortunately our budget has been way out of whack since Molly was born! So many baby things to purchase and lots of eating out right after she was born. And it seems like its always someone’s birthday, ugh.

My husband and I also have different spending habits, I am a saver and he is definitely not!

Hoping to get ours back on track soon too!

Maria says

Dave Ramsey’s advice has worked for so many people I know, so I feel it’s a great source!

We in the very beginning stages of buying for a house (just looking right now), so I feel that bugeting will become much more of a necessity to us when that happens. I hope you can teach me a thing or to (or just someone stop this little online shopping habit I have…). 🙂

Brittany says

I love house buying!!! Well, I remember being stressed about it, but I love following along on other people’s journey to buying a house. 😉 I’m excited for you!!

Verna says

I love Dave Ramsey! I’m so so bad at budgeting though. I don’t know if I just need to MAKE myself do it or what, but I have such a hard time commiting to it.

Paulina says

We just use an simple excel spreadsheet for our budget. It’s divided into fixed and varied expenses and then whatever is left after paying the bills can be used for groceries, gas, etc. We’re both savers by nature, but until recently, we had not made a plan to save purposely. Now we put 10% of our income into savings automatically which gives us a little less money to play with each week, but I love seeing our account grow and grow.

Brittany says

I love the automatic savings idea! We do that, too, and it’s wonderful because you never have the chance to miss the money 🙂

Melissa says

We just sat down on Saturday and overhauled our budget too. I never want to take the time to do it, but we already had the basics written down so it took all of 10 minutes. However that satisfaction of knowing where we stand and looking over our goals again is so worth it. We just use excel and write everything down we need to look at, weekly, monthly, and yearly expenses as well as goasl for a Freedon and Emergency Fund, vacation, kids savings, etc. Such a load off!

Lisa says

I so needed to read this today, I reallyyyy need to be budgeting this month. I’m still 21, but saving is a huge thing in my family and I already get flack from my parents that I don’t have enough saved already and that I haven’t started a retirement fund, so guess I better get on that hah. I always spend far too much on clothes and food. I’ve heard good things about mint.com, but haven’t tried it out myself yet!

Kristen @ notsodomesticated says

We definitely follow a monthly budget, but there’s also some wiggle room. Like if something comes up that we both agree we need to spend money on, then there might be a little less going in to savings that month. But we talk about everything, to make sure we’re in agreement! And I’ve done some of Dave Ramsey’s classes and really enjoyed them! I don’t follow every single thing he says, but I think he has great advice.

Brittany says

I love Dave Ramsey and listening to his talk show, but we definitely don’t follow every piece of advice. He’s uber conservative fiscally, which I admire, but it doesn’t all work for us!

Stacy K says

It’s so awesome to read about normal family budgeting. My husband is an accountant so we started budgeting on a monthly basis before we got married last Sept. Now that we are expecting a baby though it’s hard to determine how he will change our budget. I’d be interested in a post about baby expenses or budgeting for baby…. what are some of the monthly fixed costs for H (diapers, wipes, clothes etc) was there anything that shocked you as a baby expense you didn’t expect? I do plan to breast feed and hopefully continue working from home without a babysitter, but it stresses me out that I can’t really plan how much money we should set aside each month for the baby’s needs. Also now that we are in the thick of buying a crib, car seat and other necessities it feels like we will never save again!

Brittany says

Hi Stacy! I love the idea of a post on budgeting for baby. Let me tell you as an overview, though, that I’ve been surprised to not spend nearly as much as everywhere makes you think you will. Breastfeeding definitely helps keep costs down. Thanks so much for the topic and I’ll plan a post on it. As on top of everything as it sounds like you and your husband are, I’m sure you’ll be better than fine 😉

heather (alrightokeefe) says

This is a perfect post for me right now! My fiance is starting law school next month so I will be the sole bread winner as we are trying to take out as few loans as possible. I have never heard or Mint.com or Dave Ramsey – I’m goggling both shortly 🙂

Can you tell me where you got the ‘visual guide to small savings…’ I tried to find it by searching intuit. It’s too small to read and I’d like to read it if possible.

Thanks!!

Danica @ It's Progression says

My husband and I just got married less than a month ago, have now gotten our accounts set up as we want them, and are thinking about creating a budget. It’s hard since we aren’t sure yet what an appropriate range is for groceries or gas, etc. We started an account on Mint.com to track where our money goes this month and then hopefully for August we can make a more concrete budget! This is definitely a good reminder!

chelsey @ clean eating chelsey says

I let the Husband handle them. 😉

Erin @ Happier, Healthier, More Fit Me says

I’m 6 months into my maternity leave and have 6 months to go. Since I’m only getting about 35% of my regular income while off, and my husband is not on a fixed pay schedule, budgeting is tricky right now.

I set up a budget at the beginning if my leave, but love the idea of tracking all expenses for a month to see if we are budgeting accurately. I know our expenses vary each month too, and weddings definitely throw our budget for a loop…we have one next weekend.

I’ve never tried mint.com, will definitely be checking it out tomorrow. Going to look into Dave Ramsey too. Thanks!